What I got Right or Wrong in 2020

Reflecting on the Past Year

Given the new year and its already explosive start (new heights of COVID spread, fear of new strains, and the riots in Washington DC during election certification, etc.), I figure reflection is as good a way as any to start out 2021.

Holding Myself Accountable

People tend to have powerful memory self-editing capabilities when they were wrong.

In US politics, a lot fewer people seemed to remember having voted for George W. Bush vs. the actual vote. Similarly, many more people either knew that the internet would revolutionize everything (pre-about-1995) and also knew that it was all a bubble post-1995.

It's not really a conscious act (well, for most people). You can't really prevent memory from "drifting" over time. That's a great self-defense mechanism, but not so great for actually understanding what you get right or wrong.

That's why I try to write down my thoughts and share them with others contemporaneously.

In this case, I can’t do so from my Substack, but I certainly can from my own prior written correspondences, which I’ll include here.

Things I Got Right in 2020

A lot of these predictions tend to relate to VC and investment areas that Creative Ventures operates in.

I suppose it's not really that surprising, given it’s part of my day-to-day. However, I do find I tend to have more against-the-grain viewpoints than average—which is a good thing when I turn out to be right about them after the fact.

If there's a downturn in 2020, we would likely counterintuitively see MORE investment in VC

What I said:

"Note this in terms of our discussion about potential yield seeking (counter-intuitively) if there's an economic downturn:

All told, the global stockpile of debt with sub-zero yields surged to more than $14 trillion for the first time in history, according to Bloomberg data, surpassing 25 percent of the entire investment-grade market."

Me, 8/1/2019, about the potential for a recession in the coming year

What happened:

"Through Q3, US VC firms have raised a total of $56.6 billion across 228 funds, exceeding 2019’s yearly fundraising value of $54.9 billion."

Throughout 2019, I had to make predictions about what would happen (both from a practical planning perspective and in panel/Q&A settings) if we hit a recession.

It was a fairly reasonable question since we were in the midst of one of the longest sustained growth periods in history.

My response, fairly consistently, was counter to the conventional wisdom. I thought there would either be little impact or—very counterintuitively—be more capital allocation into and demand for VC.

Why? It's a matter of understanding the broader "customers" in this market, who are institutions (like pensions, endowments, foundations, etc.). These customers still have to maintain payouts for pensioners, university/foundation operations... even if interest rates are extremely low. Normally, in a downturn, you'd want "safe" assets. However, you can't do that if you're guaranteed to fall behind in your ability to pay your liabilities.

Now, obviously, VC and other high-yielding things are risky. It could be a good bet. Or it could be like going to Vegas to make your rent. Setting aside whether investing in VC to make pension payments is a wise decision, it is an understandable temptation from those institutions' perspectives.

Now, I obviously didn't anticipate a global pandemic. But the broader dynamic (again, putting aside whether it’s actually a good fiduciary decision) did actually play out as I expected (and for the reasons I expected).

COVID would immediately depress robotics/automation adoption, but we might see a big adoption wave within months

What I said:

"The summary is essentially cost-cutting automation startups will likely have success with getting corporate to adopt in a few months from now... if there can be a credible argument that the technology can be adopted and scaled in the near-ish term. If it's a mere pilot for viability, those "R&D" investments will likely get cut. It's a difference between if it's part of the innovation budget, or part of a CFO's cost-savings/labor-saving push.

Obviously, it's hard for any startup to just say, "we'll be able to deploy to all your stores/factories/etc. tomorrow" realistically, but framing could make a big difference given corporate priorities right now. CFOs may be willing to take risks at this particular point in time if it's possible to ramp back up output/operations as the economy recovers, but saves them from needing to significantly rehire/increase labor force again, given stickiness of wages/cost in needing to downsize again if the economy either recovers slower or turns down again."

Me, discussing dynamics for robotics/automation companies, 4/16/2020

What happened:

"73% of organizations worldwide are now using automation technologies – such as robotics, machine learning and natural language processing – up from 58% in 2019"

It isn’t controversial now that automation technology adoption is accelerating during the pandemic.

To understand why this was contrarian, I would have to ask readers to remember that during rising panic about COVID, there was a lot of sky-is-falling predictions, falling equity markets, collapsing global growth, and all-hands-on-deck government/central bank crisis measures being enacted.

This kind of sky-is-falling take was also prevalent in VC during early March (including Sequoia's Black Swan letter and Upfront Ventures' Funding in the Time of Coronavirus in early March). Now, to be fair, the industries I cared about (due to Creative Ventures) are not the majority of the portfolios of these other VCs. I’m not going to say that sky-is-falling was a wrong take for, say, travel startups.

Nevertheless, the general sentiment was still fear and expectation of significant innovation pullback.

What I personally expected (and came to be CV's view as a whole) was that it would actually look a lot more like 2008. Businesses would see lots of uncertainty in the future, potentially start doing deep panic layoffs, and be very reticent to re-hire without greater clarity on what was going to happen in the near future.

At the same time, we would not see wholesale collapse in aggregate demand, which means the business still need to actually operate. In an environment like this, taking a risk with productivity measures (meaning adopting tech, procedures, etc. that would make the company more efficient) suddenly becomes more attractive. If you think about it, it's a bit ironic, because you'd think that businesses would invest when times are good... but in reality, when times are good, you're too busy keeping up with demand, hiring more people, trying to expand, vs. cleaning up and improving what you already have.

In the 2008 era, a lot of the technology adoption was basic IT and digitization stuff. In 2020, a lot of the lowest hanging fruit was already grabbed (and SaaS had filled a lot of the spaces left—as well as taken over a lot of it—within the IT landscape since 2008). There was less to optimize in the paper/digital realm, which left a lot more to be handled within the physical.

The pandemic actually exacerbated this even more than the natural trends would because now you also have an extra handicap of having capacity/spacing limits, in addition to all of the other challenges and limits you had before.

Healthcare adoption of technology, especially point-of-care related technology, would actually accelerate during COVID

What I said:

"For us, the main calculus is that the potential market for the device is massive, it exactly aligns hospital/payor incentives, and it's specifically something that has been sought after by the industry in terms of fast, POC diagnostics... [and a bunch of confidential details follow that are hard to redact] … COVID-19 does not change this [and might actually exacerbate the needs]…"

Me, in response to a question about a specific investment, 3/19/2020

What happened:

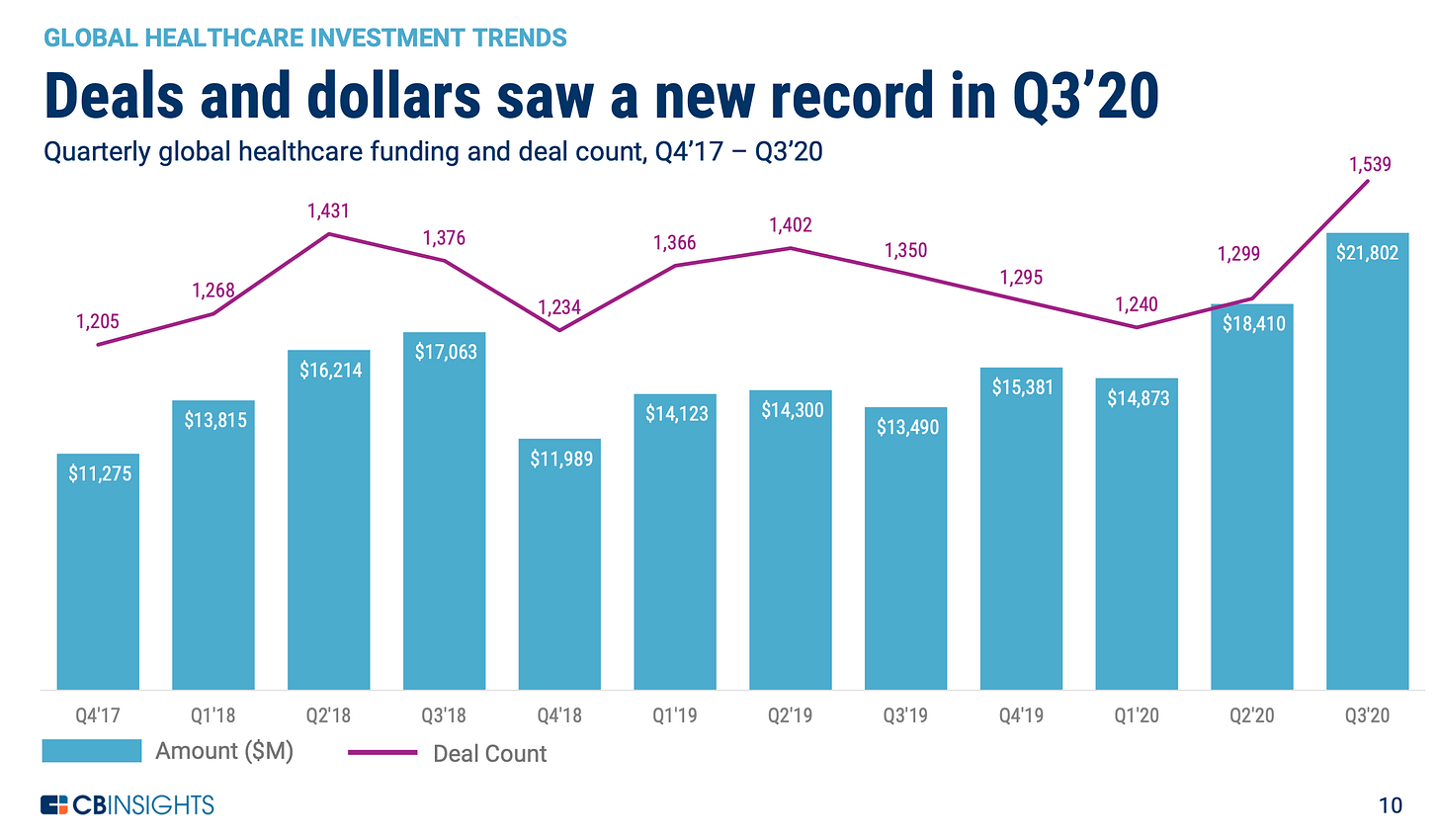

CB Insights State of Healthcare Q3 2020 (October 14, 2020)

While investment dollars aren't everything, it's hard to actually get a good single metric of "adoption" speed. It's at least indicative, and anecdotal accounts from both hospital administrators and healthcare companies have largely aligned with a boom in innovation adoption.

Now, obviously, this could have gone very differently.

COVID has been hell for many hospital systems. Hospitals/providers are typically are the ones who end up directly buying new technology. It would be more than fair to predict that they'd have their hands so full that no one is going to stop and care about adopting new stuff.

And, to be fair, this was an “iffier” prediction on my part. I followed the same logic as automation technology in, say, logistics (where demand has skyrocketed due to e-commerce, but it’s hard to even operate at pre-pandemic levels due to staffing uncertainty from illness/spread, etc.), but I was a lot less certain that this would occur. Healthcare is just generally weirder in incentive structure and decision-making.

That being said, when you’re desperate and someone offers you a magic pill, if it even has some level of credibility, businesses will often be a lot more interested than when times are good and see no need to change what they’re doing.

A shared theme

All of these predictions actually share a single theme, which is existing strains predisposed them to go in a certain direction. When even more stress and shock were applied, the cracks from those strains just accelerated.

That is a lot of what CV tries to predict on and what I think is the root of good analysis as well.

You don't actually need to be brilliant at "predicting the future" in order to able to give good takes on these things—a better grasp of the present actually suffices and makes you look prescient.

Thing(s) I Got Wrong in 2020

Now, 2020 was a pretty good year for my prognostications.

I think there were a lot of things I generally got right that weren't "hard" views of the same nature (e.g. discussing 2020 politics, polling errors, the nature of uncertainty, etc.). And there were some minor things, loosely held, I got wrong (polling error directions, what might happen within housing markets, etc.).

There was one area that I did take a more moderate-to-strong stance on that turned out to be quite wrong. And since then, I've revised my views quite dramatically.

The Direction of China under Xi

What I said:

"I don’t know if I buy this vs Jacob Shapiro’s take. Why should Beijing really care that much? HK is separate enough that contagion of unrest spreading seems unlikely.Cracking down would promote international response. It’s not like HK is the center of its economy anymore."

Me, reacting to George Friedman's thoughts on China and a global economic contraction. (August 15, 2019)

"As I’ve mentioned before, Xi’s star is probably fading with all this stuff going on. I find the idea that the leaked documents are from opponents at the highest level of Chinese government reasonably plausible as well."

Me, during the period with leaked documents on the Uighur detention and "retraining" camps and public questioning of Xi by various high-profile officials (November 19, 2019)

What happened:

Well, I don't think I really need to separately post what ultimately happened in terms of Hong Kong and Xi's hold on power within the CCP since.

Amateur Geopolitics

To be fair, I’m not a geopolitical professional, though I do dabble (and people ask me questions about it anyway) especially where it relates to history. To be fair, though, China is hard to avoid when talking about technology or anything else that has global scale.

And China is complicated. It tends to evince extremely polarized opinions thanks to the aggressive moves that the Party under Xi has made.

That being said, the dynamics and even morality within the Chinese context are quite complex. Uyghurs/Hong Kong and the Century of Humiliation. Sea lane aggression/claims and the Second Sino-Japanese War/Rape of Nanking (Nanjing). Social credit/police-state control and raising nearly a billion people out of abject poverty.

To be clear, from where I sit, I think a lot of things the Chinese state has done, is doing, and likely will do are morally wrong. But it’s also hard to be quite as glib about moralizing if you know the context that a lot of these things come from.

From Deng’s “bide your time” to Xi’s Confidence Doctrine

From the emergence of Xi Jiping Thought, to the recent saga with Jack Ma and Ant Group, the era of pragmatic, Wild West capitalism in China is more or less over.

To be fair, the Deng Xiaoping quote on black cats and white cats hunting mice all the same has always been misinterpreted. The simplistic description has always been a kind of non-ideological "well, whatever works." In reality, the context was much more along the lines of, "we have other priorities," with the economic conditions in China, especially widespread poverty. It was never a repudiation or "setting aside" of CCP ideology (which many western observers have thought).

China had never committed to quiet democratic liberalization. It was just a loudly spoken assumption by western democratic countries as China became more prosperous. I at least knew this context.

My surprise is still more timing. China still has quite tenuous alliances (if you can call them that) that are largely transactional. It's surrounded by rivals/enemies—at the very least, lots of countries that do not like it. And there's still a huge impoverished population (which drives the CCP's interest in promoting continued growth to ensure societal stability).

From a purely strategic perspective, Xi and China alarming and alienating much of the West does not make much sense. This is especially in light of the CCP (to a fault) always being patient and pragmatic, with far, far longer timescales than other countries for its plans. When in doubt, China internal policy that looks nonsensical can be safely assumed to have a calculated, practical reason—even if it’s one that is confusing/unfamiliar in a western democratic context.

Or, at least it used to be safe to assume.

Conservative, committee-style decision making which characterized past administrations seems to have been jettisoned. My guess at this point is this has to do more with Xi himself and the centralization of control fully under him.

I think it’s fair to say, and I’ve come to expect, that China will be a lot more unpredictable going into the future and we should expect a far wider range of possibilities as to both what happens with it and what it does.

Going forward from here

Hopefully, as we go into the next year, I’ll have more predictions and reflections that we can pull right from the Substack.

Stay tuned and let me know what kind of content you all would like to see going forward!